Join Us for a Used Auto Sale (February 1 - February 28, 2026)

From February 1 - February 28, 2026, visit any California Enterprise Car Sales location and when you finance your new ride with The Police Credit Union, you'll receive a 1.00% APR loan rate discount* for terms up to 72 months!

Plus get a $50 bonus to help you fill up your tank!**

*Terms and conditions apply. **$50 bonus will be deposited to members account who finance a vehicle with The Police Credit Union through Enterprise Car Sales on February 1 - February 28, 2026, 4 to 6 weeks after the end of the month.

Learn More About Our Car SaleSave time and money

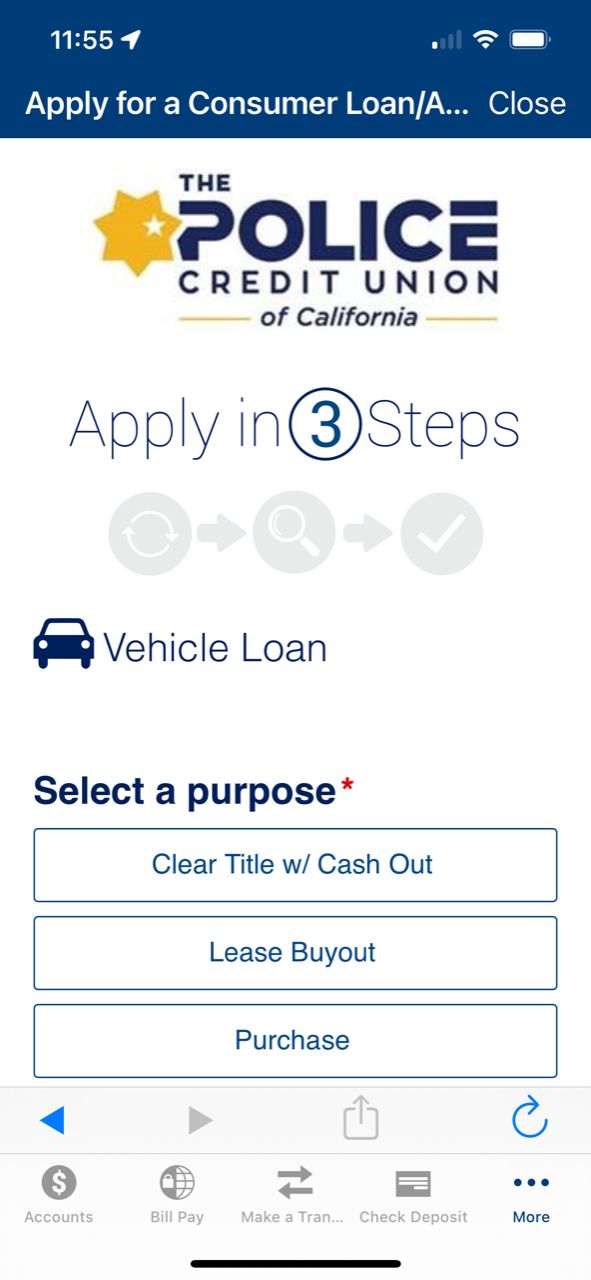

We make financing easy. Our streamlined process and loan officers get you in your new vehicle quickly and painlessly!

New auto rates as low as 5.14% APR1

Loan amounts up to $150k

Convenient payment options

No payments for 90 days

GAP Insurance and Payment Protection are available

Easy and secure online application process

Explore our Auto Loan rate options.

Why choose The Police Credit Union for your Auto Loan?

What our members are saying

"Nelly was a pleasure to work with for are personal loan and vehicle loan. Nelly went above and beyond making sure we received the best rate possible and made the process extremely easy to go through. With my crazy schedule working in law enforcement and my husbands schedule working at the hospital, Nelly stayed respectful and flexible with our time and even stayed late to make sure we could get everything done. It’s employees like this, that work for The Police Credit Union, is why my husband and I are members. We will definitely be staying as members and will continue to utilize The Police Credit Union services, knowing we can deal with educated, respectable employees. Thank you!"

"I bought two cars and needed two car loans within about a month’s time. James at the San Bruno branch helped me finance both cars without any hassle. The process with James was so smooth and easy. James is also very friendly and professional. The credit union’s car loan rates were also very low and competitive. I (and my whole family) only have accounts with the SF Police credit union. I don’t trust other banks and have closed their accounts a long time ago. Thank you for your credit union! Please continue the excellent job!"

Auto Loan FAQs

-

What information do I need to apply for an Auto Loan?

To get you started, here’s a checklist of items you may need for your Auto Loan:

- Proof of identity

- Proof of income

- Credit and banking history

- Proof of residence

- Vehicle information

- Current vehicle registration (for trade-in)

- Proof of insurance

- Method of down payment

-

Do I need to be a member to apply for an Auto Loan?

Membership is not required to apply, but you must establish membership prior to the loan being funded.

-

Do you offer financing for vehicles outside of California?

Out-of-state vehicles may be acceptable on franchise dealer transactions only if you reside in the same state you purchase from. Please contact us to see if your purchase qualifies.

-

How long is a pre-approved Auto Loan good for?

A pre-approved Auto Loan application is good for 60 days, but the quoted interest rate can be subject to change.

-

Are there any types of vehicles TPCU does not finance?

- Vehicles used for commercial or business purposes (we do offer Personal loans up to $50k)

- Salvaged or branded-title vehicles

- Gray market or lemon law vehicles

- Conversion or delivery vehicles

-

What type of Auto Loans do you offer?

TPCU offers a variety of Auto Loans:

- Dealer purchases (when you purchase a new or used car at a dealership)

- Refinancing of current auto loans

- Lease buyouts (when you decide to purchase your leased vehicle)

- Private party (when you are buying a car from another individual) in CA only. Seller and buyer must make an appointment inside one of our branches

-

Are there any specific terms and conditions I should be aware of before applying for an Auto Loan?

A variety of factors determine terms for your Auto Loan, but you should be aware of the following:

- Term limitations may apply

- Loan-to-value restrictions apply

- A down payment may be required

- Title and state fees may apply

- Must be an existing member or become a member of the Credit Union

Apply now to see if you qualify for a new, used or refinance Auto Loan

Our fixed, competitive auto loan rates and convenient online application get you on the road to saving more money.

We're Here to Help

Other ways to connect with us

Call us at 800.222.1391 or find a branch location, by clicking the button below.

Our LocationsMeet with us virtually

Schedule an appointment or meet a member of our Virtual Branch team from your computer, laptop, or mobile device

Visit our Virtual BranchVirtual Branch Hours

Monday - Friday: 10:00 a.m. - 5:00 p.m. PST

Saturday: 9:00 a.m. - 3:00 p.m. PST

1APR = Annual Percentage Rate. Example new auto rate of 5.14% APR with 36 monthly payments = $30.03 per $1,000 borrowed, loan to value <=75%. +73-84 month New and Used Auto loan requires a minimum loan amount of $25,000. Rates quoted above assume excellent borrower history. Out-of-state vehicles may be acceptable on franchise dealer transactions only. Rates, terms and conditions are subject to change without notice. Maximum vehicle mileage = 175,000. New auto is defined as 2026 or 2025 with 7,500 miles or less.

21.00% off current credit union rate, with a maximum loan term of 60 months. Offer valid now to 12/31/2026 and is subject to change without notice. This offer cannot be combined with any other offer. Used vehicles were previously part of the Enterprise rental fleet &/or an affiliated company’s lease fleet or purchased by Enterprise from sources including auto auctions, customer trade-ins or from other sources, with a possible previous use including rental, lease, transportation network company or other use.

External Link Alert

You are leaving our website and linking to an alternative website not operated by us. The Credit Union does not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.

The Credit Union is not liable for any failure of products or services advertised on those sites. Each third-party site may have a privacy policy different than the Credit Union; and the linked third-party website may provide less security than the Credit Union's website. If you click "OK", an external website that is owned and operated by a third-party will be opened in a new browser window. If you click "CANCEL" you will be returned to our website.